- Middle Eastern countries see role f...

- China-India bid can forge united As...

- New Delhi’s moves with Hanoi on S. ...

- China-Sri Lanka Cooperation during ...

- The Green Ladder & the Energy Leade...

- Digital juggernaut will usher in ne...

- US throttles global digital unity a...

- Address Three Challenges to Multila...

- Building a more equitable, secure f...

- Impact of the COVID-19 Pandemic on ...

- Identifying and Addressing Major Is...

- China’s Economic Initiatives in th...

- Perspective from China’s Internatio...

- Commentary on The U. S. Arctic Coun...

- Opportunities and Challenges of Joi...

- “Polar Silk Road”and China-Nordic C...

- Strategic Stability in Cyberspace: ...

- Glоbаl Есоnоmiс Gоvеrnаnсе: Nеw Сhа...

- Promoting Peace Through Sustainable...

- Overview of the 2016 Chinese G20 Pr...

- Leading the Global Race to Zero Emi...

- Addressing the Vaccine Gap: Goal-ba...

- The EU and Huawei 5G technology aga...

- China's growing engagement with the...

- Perspectives on the Global Economic...

- International Cooperation for the C...

- Working Together with One Heart: P...

- The Tragedy of Missed Opportunities

- Rebalancing Global Economic Governa...

- Political Decisions and Institution...

Jan 01 0001

Transformation and Innovation in the EU’s Bank Regulation and Supervision System in the European Debt Crisis Context

By HU Kun and LIU Dongmin

In June 2012, the EU Summit came up with the Single Supervisory Mechanism– SSM. According to this resolution, the European Commission submitted a proposal to the Council of the European Union on September 12 for “a Council Regulation conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions”. After discussions and revisions, the proposal won approval at the EU summit in December that year. On April 18, 2013, the EU council reached an agreement with the European Parliament on the final draft which was then approved by vote of EP on May 22.

In June 2012, the EU Summit came up with the Single Supervisory Mechanism– SSM.[1] According to this resolution, the European Commission submitted a proposal to the Council of the European Union on September 12 for “a Council Regulation conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions”.[2] After discussions and revisions, the proposal won approval at the EU summit in December that year. [3] On April 18, 2013, the EU council reached an agreement with the European Parliament on the final draft[4] which was then approved by vote of EP on May 22.[5]

The ECB will assume its new banking supervision responsibilities in November 2014, 12 months after the SSM Regulation enters into force.[6] Now it’s our turn to ask, is this “perfection” of the old banking supervision mode of EU or does it mean the “transformation” of its supervision mode and idea? If it’s transformation, what’s the incentive behind it? And compared with the old one, what features does the new supervisory system have? To answer these questions, we have to sort out the old banking supervision system of EU which has a lot to do with the integration process of EU banking market.

I. The Integration Process of EU Banking Market Prior to the European Debt Crisis

In 1951, the then French foreign minister Robert Schuman proposed to initiate the European Coal and Steel Community – ECSC, which is the first actual step to turn European economic integration into reality. [7] In 1957, the Treaty of Rome was signed and the European Economic Community—EEC, whose main goal was to set up a European common market where goods, services, labor and capital can freely flow--was established, laying the foundation for integration of EU financial service market.[8]

The financial system of EU countries (with Britain excluded) is bank-oriented. Banks are systemically important characters due to its function of providing fluidity to enterprises and other financial institutions in the market. Statistics suggest that from 1995 to 2004, the average ratio of bank credit of EU-25 to their GDP is 109.2%, with EU-15 as high as 114.6%; while this index of America and Japan is only 40.7% and 79.7% in 2001[9]. So it’s since the beginning that EEC/EU has adopted the bank-oriented financial integration policy.

1. The related polices to push forward EU banking integration

To push forward the integration process of banking within the region, EEC/EU successively took the following measures.

1.1 Eliminate the access barriers

With regard to the then access barriers exist in each country, EEC implemented the “national treatment principle” within the region, i.e., all the financial institutions of a country, no matter whom they belong to, are subject to the same regulations and supervision. In June 1973, the Council of the European Communities issued The Abolition of Restrictions on Freedom of Establishment and Freedom to Provide Services for self-employed Activities of Banks and other Financial Institutions, thus clearing the way for EEC countries to run banking business in one another. [10]

1.2 Coordinate the supervision rules

After the market access barriers are eliminated, the banks of EEC countries can take up and pursue business in each other, but due to each member country’s different banking supervision rules, the costs of cross-border banking operations are greatly increased. Since the differences between the supervisory modes of member states cannot be immediately eliminated, EEC adopted the “minimal harmonization” policy so as to reduce the resistance to integration of banking sector. [11] In 1977, the EEC council released First Council Directive on the coordination of laws, regulations and administrative provisions relating to the taking up and pursuit of the business of credit institutions, i.e., First Banking Directive, starting the coordination process of supervisory rules of European banks. [12] In 1989, the Council of EEC published the Second Banking Directive, which furthered each country’s supervision rules like the capital adequacy ratio standards, large loans regulations and banks’ eternal rights to participate in the supervisory coordination of non-financial sector business. [13]

1.3 Determine the limits of supervisory authority

The issue of whether the related banks are supervised by host states or home states came up with the advent of cross-border operations of banks. Actually, ambiguity of supervisory authority will bring great concern to bank supervisors and banks themselves and hamper the normal cross-border operations of banks. In 1985, with the deepening of coordination of supervisory rules, Commission of the European Communities submitted the white paper “Completing the Internal Market” to European Council, stating the plan to perfect the single market by the end of 1992, and raised the principles of single banking license, home country control and mutual recognition in relation to banking supervision.[14] These principles are manifested in the Second Banking Directive. According to this directive, rights of prudential supervision is granted to the bank’s home state, which means that once gaining approval of one country, the banks of EEC member states can provide cross-border financial service or set up branches in all other member states (branches mean the subsidiaries registered in other member states according to the local laws and regulations whose home state is right the place where it’s registered). At the same time, the “host country” has the obligation to protect the public interest of its people, so it will carry out conduct-of business supervision to protect the interests of bank customers.[15] These rules clearly set the boundary of banking supervision authority and paved the way for mixed operations of EEC/EU. [16]

1.4 Break down the supervision and market barriers

After making clear the relationships between the organizations of banking sector, EEC/EU started to break down the supervision and market barriers to promote the free flow of regional capitals and supply of cross-border financial service of banks. The main measures include:

(1) The Directive on Liberalization of Capital Flows issued in 1988 requiring canceling all foreign exchange control and capital flow restrictions.[17]

(2) Directive on Deposit Guarantee Schemes[18] passed by EU council in 1994 which brought in the compulsory deposit insurance for all EU financial institutions.[19]

(3) The consensus reached by European Council based on the Delors Report in terms of establishing Economic and Monetary Union on three steps.[20] This plan was written into Maastricht Treaty which was signed in 1991.[21] In 1999, the common currency—Euro was born and all the countries that joined the Euro zone should share the same currency, monetary policy and central bank. Up to January 1st, 2011, there were 17 EU member countries using euro.[22] Meanwhile, the Trans-European Automated Real-time Gross Settlement Express Transfer (Target) started to be used. [23]

(4) In 1999, to match up the new money - euro, European Commission issued the Financial Services Action Plan- FSAP which includes a series of measures to promote the total integration of banking industry and capital market.[24] This plan was based on Markets in Financial Instruments Directive- MiFID that aims at facilitating investors taking cross-border activities within Europe.[25]

2. Integration of the EU banking sector prior to the European debt crisis

Pushed by different measures like the above-mentioned ones, the banking sector of EU (especially the euro zone) is getting more and more integrated.

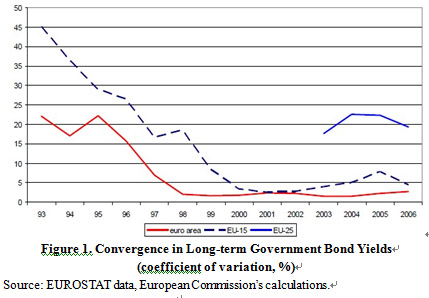

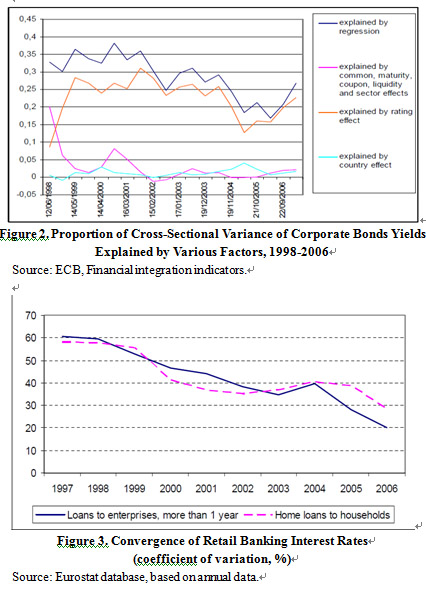

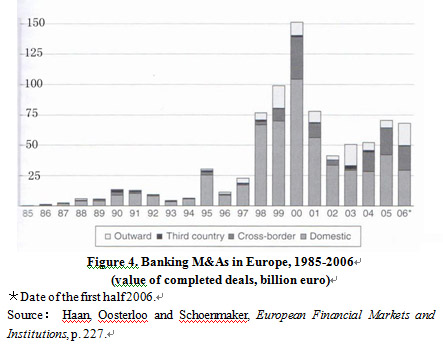

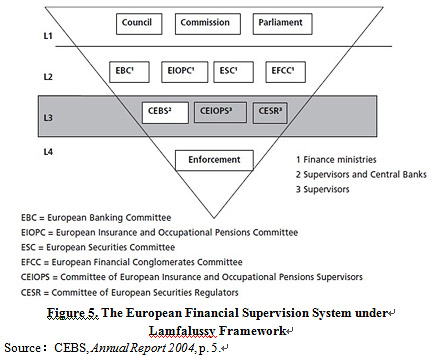

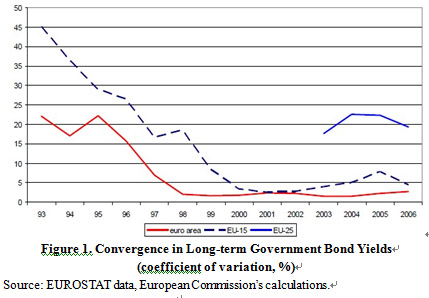

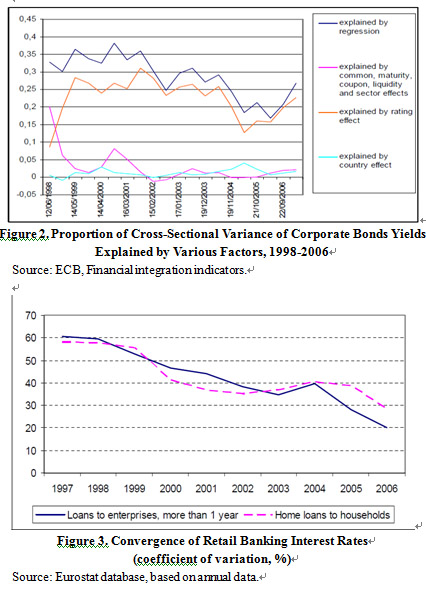

2.1 Price-based indicators

According to “law of one price”, the trend of convergence of bank asset prices or returns (i.e., interest rates) can lead, to a certain extent, the deepening of banking integration. Before the European debt crisis, the wholesale banking business of EU like inter-bank borrowing, government bonds, investment banking and various financial derivative markets have been highly integrated: the return rates of the monetary market and government bonds (especially for the Euro zone countries) had been nearly totally converging (Figure 1); that of enterprise bonds is more influenced by a variety of common factors and hardly influenced by the environment of its local country (Figure 2). [26] Though retail banking business is slow in the process of integration due to the limitation of various elements[27], it does have an obvious trend of interest rate converging.

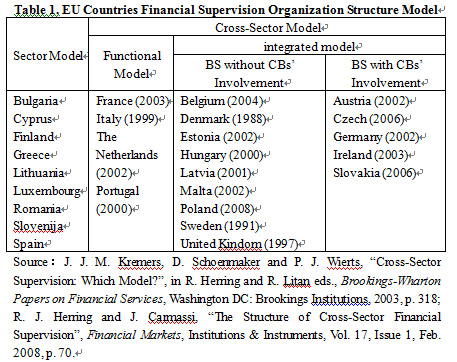

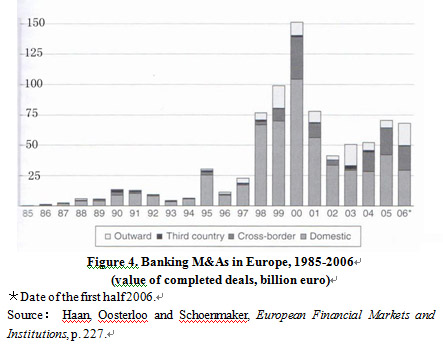

2.2 Quantity-based indicators

The integration of banks also means the increase of various cross-border businesses of credit institutions. From the year 1995 to 2006, EU banking sector’s average cross-border penetration index rose from 11% to 19%.[28] Among the 30 biggest EU banks[29], the number of European Bank rose from 7 in 2000 to 11 in 2005, while Domestic Bank and Global Bank were respectively reduced in number by 2.[30] At the same time, mergers and acquisitions of EU banks (and financial transaction market) drew people’s attention; this was because, on the one hand, the integration-pushing measures and policies of EU intensified the competition between banks, which resulted in banks (and financial exchange market) seeking for strengthening competitiveness by mergers and acquisitions; on the other, these measures and polices did create opportunities for banks (and financial exchange market) for cross-border merger and acquisition—especially since the start of EMU, mergers within EU have been booming (Figure 4) and credit institutions constantly decreasing in number.[31]

2.3 Summary

As an important part of the economic integration, integration of EU financial sector is deepening under the push of EEC/EU. And because of the bank-oriented feature of its financial system, the integration course of banks is no doubt taking important place. In this process, the cost and returns of capital of member states are tending to be the same, cross-border banking business is growing, and the relationship within EU banking industry is getting close with the impact on each other tightening and the overall industry revealing a high level of integration.[32]

II. EU Banking Supervisory System Prior to the European Debt Crisis

The policies put forward by EEC/EU for promoting the integration of banking sector are in themselves the adjustment and construction of supervisory system based on different levels of banking integration, and their core idea is the “home country control combined with minimum standards and mutual recognition” principle. Under this guiding principle,[33] the EU banking supervisory system before the European debt crisis had the following characteristics:

1. Discrete supervision structure

In general, banking supervision contains three dimensions which are macroprudential supervision, microprudential supervision and business conduct supervision. The function of macroprudential supervision is coping with systemic risk so as to maintain the whole financial system’s stability, or to avoid financial shock imperiling the real economy; while the aim of microprudential supervision is to ensure well functioning of credit institutions so as to render them solvent. These two supervision modes are called prudential supervision in general[34], which are mainly realized by monitoring, alarming for and controlling capital adequacy rate, liquidity and risks and crisis management.[35] For business conduct, it’s mainly dedicated to realizing the equality and integrity of the market to guarantee the benefits of bank customers.[36] In supervision practice, these three dimensions are closely related: sound commercial behavior supervision can raise the prestige of credit institutions and reduce their operating risks while solvent credit institutions can at most times reduce the systemic risk of financial market. The vice versa: the stable financial market can provide good operating environment to credit institutions while ensuring and improving the solvency of credit institutions also means protecting the rights and interests of bank customers.

Second Banking Directive respectively confers (micro)prudential supervision rights and business conduct supervision rights on home country and host country while section 5, article 105 of Maastricht Treaty explicitly states that member countries have the authority over micro and macro prudential supervision of banks, [37] which lays a legal footing for the discrete model of EEC/EU banks’ supervision system. Under this system, the bank supervision rights are reserved to member countries, i.e., member country is responsible for macro and micro prudential supervision while the host country is responsible for bussiness conduct supervision.

2. Diverse supervision models and rules

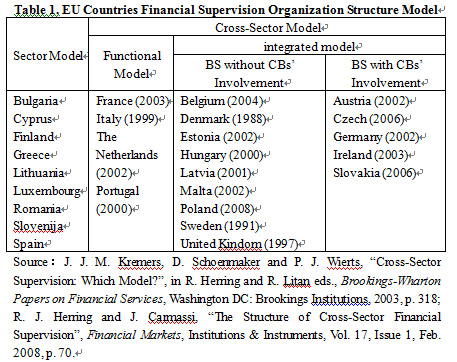

According to the difference of organizational structure, financial supervision mechanism can be divided into traditional sector model and cross-sector model that occurs with the increase of mixed operation; cross-sector model can be further divided into functional model and integrated model.[38] Under the functional model, prudential supervision and business conduct supervision are respectively taken charge of by two institutions independent of each other. The advantage of this model is that it does not separate the responsibility of macroprudential supervision and that of microprudential supervision, which can help cope with financial risks more rapidly and effectively. While under the integrated model, a certain institution is responsible for business conduct supervision and microprudential supervision, and macropurdential supervision of the financial system is taken charge of by another institution. This model’s advantage is that the credit organization needs only to communicate with one supervision institution, which makes supervision more flexible and efficient. In fact, these two mixed operation models have their own strength for which each other is lacking. Because of different development path, financial supervision models within European countries are different to each other.[39] Up to 2006, there are 9 countries using the traditional sector supervision model, 4 using functional supervision model and 14 using integrated supervision model (table 1).

In addition to this, under the guidance of “home country control combined with minimum coordination” principle, the supervision rules and practices of European countries are also diverse from each other, for instance the definition of the credit institutions and the important supervision indicators such as core capital and Shareholder’s equity, Procedure of the asset evaluation, risk assessment and deposit insurance, content and practice of the regulation rule. [40]

3. Supervision cooperation and coordination system

With the integration of EU banking industry going further, cross-border business of banks is increasing, and cooperation and coordination of banking supervision within member countries of EU starts to occur. There are two main ways for this: one is through signing bilateral or multilateral memorandum of understanding to ensure effective daily supervision of credit institutions that undertake cross-border businesses; the other is setting up various committees at EEC/EU level to coordinate the supervision of rules and practice so that a fair competition environment is created for the credit institutions in the region.[41]

As early as in 1972, the member countries of EEC set up Groupe de Contact – Gdc to promote the communication of banking supervision information between the supervision institutions, and cooperated in real supervision practices. In 1978, EEC initiated the Banking Advisory Committee – BAC to provide consultancy for the issue of supervision rules.[42] In 1998, Banking Supervision Committee was set up in European System of Central Banks – ESCB so that the system can fulfill the related legal tasks in matters of banking supervision and maintaining the stability of financial market. This Committee can also provide consulting service to the banking supervision institutions of each country.[43]

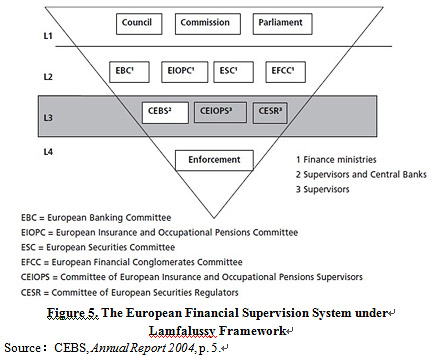

In 2002, under the guidance of Financial Services Action Plan, EU started to build a systemic supervision cooperation and coordination system, i.e., the Lamfalussy Framework. This Framework has four levels:

——The first which consists of EU Counsel, European Commission and European Parliament, is responsible for making financial supervision-related Directives and Regulations through normal legislative procedures at EU level;

——The second which in the banking supervision field is mainly EBC, is responsible for making detailed technical measures that are congenial to market development;

——The third level is for promoting the cooperation and connection of each country’s supervision institutions on the legal basis of the previous two levels and is taken charge of by the Committee of European Banking Supervisors – CEBS, whose main measures include offering interpretative recommendations, fulfilling guidelines of legal provisions and common standards that are not covered by the above two levels and recommending the optimum regulatory practices based on assessment and comparison; and

——The fourth level is performing duties in cooperation with related institutions of EU and its member states. Before the European debt crisis, this framework is the main tool for banking supervision cooperation and coordination of EU (Figure 5).[44]

4. Summary

Before the European debt crisis, the banking supervision system obeyed the “home country control combined with minimum standards and mutual recognition” principle and basically did not change the existing banking supervision system so as to promote the integration process of EU banking industry as early as possible. Under the guidance of this principle, the supervision system of EU banks reveals a discrete characteristic, i.e., each member state relying on their own with their supervision model and rules different from each other. To meet the challenge of integration, EU tried to set up a series of institutions and frameworks to realize effective coordination and cooperation of supervision.

With the deepening of banking integration, especially after the introduction of euro, the relation between the financial markets of EU countries is strengthening with the increasing vulnerability of EU financial market.[45] Some people started to call for building a single supervision institution for the banking industry at EU level to maintain the stability of financial market. But EU thinks that the existing different banking supervision models and rules of member states are gradually formed in the long-term development, fit for each country’ national conditions, and compared with the single supervision mechanism at EU level, this discrete supervision system can exert more effective and flexible supervision on each country’s banks; as to the issues of financial market stability and risk management brought by the deepening of integration, they can be solved by prudential supervision by member countries and their further coordination and cooperation under the Lamfalussy Framework.[46] Moreover, banking supervision involves the sovereignty of member countries and is not an purely economic issue; the banking supervision system currently can be said to be political optimal.[47] However, this opinion was totally overwhelmed by the impact of the European debt crisis.

III. The European Debt Crisis and Supervision Dilemma of EU Banks

1. The European debt crisis

From 2005-2006, the American real estate bubble shattered. In November 2006, the real estate price began to fall and the risk of subprime mortgage was getting obvious. In March 2007, the serious bad debt issue of subordinated debt of New Century Financial Cooperation, the second biggest subprime lending corporation in America, was disclosed, which caused investors to lose confidence in mortgage securities and market to be in a panic, starting America’s Subprime Mortgage Crisis in 2007. In September 14th, 2008, Lehman Brothers Holding Inc filed for bankruptcy, and in the same day, Merrill Lynch was purchased by Bank of America, causing global stock market slump. The crisis spread rapidly worldwide and gave rise to credit squeeze and liquidity shortage, changing American Subprime Crisis into international financial crisis and plunging the global financial market into concussion.[48]

This crisis also brings huge impact on European financial market. Early in September 2007, the fifth biggest credit institution in Britain, Northern Rock, met a dilemma because of liquidity shortage due to stagnation of international financing market. [49] Furthermore, after the outbreak of international financial crisis, the main mortgage bank of Britain, Bradford & Bingley; the biggest bank of Spain, Grupo Santander; Fortis of Holland, Belgium and Luxembourg; the second biggest mortgage bank of Germany, Hypo Real Estate; the third biggest bank of Iceland, Glitnir; Dexia of France and Belgium; six large banks of Ireland such as Allied Irish Banks and Bank of Ireland; and UnitCredit of Italy and many banks of Greece and Central and Eastern Europe immediately got into difficulty of liquidity.

With the crisis expanding and fermenting, more and more European banks encountered the problem and even their real economy is affected. To maintain the stability of financial system and curb recession of macro economy, the governments of European countries took a series of bailout measures which include nationalizing problem banks[50], providing deposit guarantee[51], direct asset injection[52] and economic stimulus package, but these also increased the burden on public finance and caused market’s concern about the discontinuity of public finance in some countries[53], which finally ignited the sovereign debt crisis.[54] Since the banks of European countries were holding a lot of problem national bonds at hand, there was panic in the market about sovereign debt default leading to write-down of bank portfolio, inter-bank borrowing and market liquidity greatly shrank and the financial market was once again in concussion and finally evolved into a vicious circle of sovereign debt crisis and banking crisis. The EU/Euro zone’s financial market was on the verge of breakdown.

2. Trilemma of European bank supervision

Though the financial market of EU/Eurozone is getting stable with the introducing of Outright Monetary Transactions – OMTs and European Stability Mechanism – ESM, [55] crisis has shown that under the highly integrated EU banking industry background, the discrete EU banking supervision system that conforms to the “home country control principle” cannot effectively maintain the stability of EU financial market. This is because:

First, the deepening of integration of EU banking industry has stepped up the competition between banking institutions.

Under the discrete supervision system of “home country control”, the member countries, in order to strengthen their homeland financial industry’s competency, compete to relax the supervision on their homeland banks. Low interest rate, sufficient liquidity and easy credit approval directly lead to EU especially Eurozone’s excess expansion of loan issuing.[56] In January 1998, the total amount of credit and money supply of Eurozone, M3, were respectively 7.1976 trillion and 4.2405 trillion while in December 2008, they grew to 15.5341 trillion Euros and 9.4011 trillion Euros—both amounts of increase more than doubled.[57] Over the same period, GDP rose from 6.1689 trillion to 9.2416 trillion Euros, increased by only less than half.[58] In 2008, the leverage ratios of the major banks of EU were generally at 35 with that of Deutsche Bank as high as 52. Contrary to this, even the major banks in America had a leverage ratio at the same period of below 20.[59] The excess expansion of the assets of European banking industry and too high leverage ratio caused the EU financial market to be in lack of risk tolerance when confronting the outside impact (e.g., the liquidity and credit squeeze resulted from the subprime crisis), which sowed the seeds of European debt crisis.

Secondly, since the European financial market has been highly integrated, the multinational banks can make policy and participate in activities on EU basis, but under the discrete supervision system, each country can only supervise on national level, which provides the possibility that the multinational banks utilize the difference between supervision rules and practice to evade supervision and acquire the biggest benefit.[60]

At the same time, under the principle of “home country control”, the host country has no authority over the branches[61] of foreign banks within its border; even if it can supervise, it cannot effectively avoid the impact of mismanagement of parent company on its financial market, because the host country has no right to supervise the parent company while the activities of branch companies are unavoidably influenced by parent company’s decision making and activities.[62] This has been fully proved by the banking crisis of Iceland in 2008.[63] From this we can see that in the context of highly integrated banking industry and frequent cross-border activities of various kinds, the member countries have no way to exert effective macroprudential supervision on their banking industry to maintain a stable financial market. So it’s understandable that for the new member countries of EU that have a high ratio of foreign assets in their whole banking assets, their banking industry and financial markets were first affected by the world financial crisis and caught in undulation.[64]

Thirdly, high integration of EU banking industry has resulted in continuing strengthening of the correlation of financial markets, whereas, under the discrete supervision system, there is no supervision institution that is responsible for the whole area’s financial stability because the supervision institutions of member countries are merely focusing on the safety of their homeland’s financial institutions and market, which does not necessarily lead to financial market’s stability.

In particular, when a country’s financial industry’s interests is in conflict with EU as a whole (or other member countries), the supervision authority of that country may put its national interest over EU (or other member countries) and stop the nascence of common solutions, which will cause dilemma for collective action.[65] After the outbreak of sovereign debt crisis, liquidity started to contract, financial system risk increased and the banking supervision departments of European countries successively imposed stricter requirements on capital adequacy ratio of their country so as to avoid crisis’ impact on homeland banks and financial market. But, this has resulted in severe shrinkage of inter-bank lending market: various banks would like to deposit money in European Central Bank, which, on the contrary, intensified liquidity shortage and amplified the risk in European financial market.[66]

Fourthly, in the context of banking integration, stable and systemically important multinational banks are emerging in the market, and when they are in crisis, the discrepancy of supervision rules and practice of member countries under “home country control” will affect the crisis management effect of banks; on the other hand, the portfolios of banks are rapidly expanding, so if the banking industry of a country is in crisis, a single member country (for example, Spain) may lack of ability to bail it out, while under the “home country control”principle, EU does not have the corresponding mechanism to implement single crisis management, which makes them unable to timely and effectively cope with crisis and the EU financial system more unstable.[67]

Fifthly, under the Lamfalussy Framework, cooperation and coordination have been proved to be unable to solve the above problem. Under the “home country control” principle, in light of the difference between legislation principle and technical rules of each country, EU usually issues the first level of law in the form of Directives[68], which gives room for member countries to implement and leads to the fact that a single text of terms cannot be formed on the third level. What’s more, since these texts themselves are not legally binding, the member countries have the right to choose whether to adopt or not. Speaking of this, this framework cannot eliminate the huge discrepancy between the supervision rules and practice of each member country, and adding that it is the member countries that hold the real banking supervision rights and EU does not have a coercive coordination organization, when on the fourth level of implementation, it’s hard to realize effective and efficient coordination and cooperation, especially when there is conflict of interest between member countries or a member country and EU.[69]

In summary, in the background of highly integration of EU banking industry, the discrete banking supervision system cannot guarantee a stable EU financial system but even adds risk to financial market, and after the outbreak of crisis, it cannot help realize timely and effectively crisis management. These problems have been fully manifested in the European debt crisis. So the European banks are facing a “Trilemma”, i.e., a stable financial system, an integrated financial system and national financial supervision cannot be acquired at the same time.[70] In face of the fact that the banking industry has been highly integrated, EU is bound to whether stick to “politically” correct policy, i.e., reserves the banking supervision rights to member countries and ignores the risk of a fluctuating financial market, or change the governing mode, i.e., let each country hand in the banking supervision rights and build a single regional supervision mechanism to maintain the stability of financial market.

IV. Transformation and Innovation in EU Banking Supervision Model

Influenced by the crisis, there is fundamental change in the concept and model of banking supervision of EU, i.e., they do not focus on whether taking the banking supervision rights from member countries or not but on maintaining the stability of financial system, i.e., turning from the “home country control” principle to “prudential supervision”.[71] Their main thoughts are: 1. making a single supervision rule that has more operability and coerciveness to maximize the convergence of supervision rules of member countries so that they can better coordinate and cooperate; 2. In light of the key place European banks take in its industry, set up a pan-European banking supervision organization to implement macroprudential supervision to maintain the stability of financial system.

1. Making a single regulation rule

In 2009, EU decided to establish three financial supervision bureaus on the basis of the third-level institutions under the Lamfalussy Framework, i.e., European Banking Authority– EBA which is formerly known as CEBS, European Insurance and Occupational Pensions Authority– EIOPA which is formerly known as Committee of European Securities Regulators– CESR and European Securities Authority– ESA which is formerly known as Committee of European Securities Regulators– CESR. These three organizations together with the Steering Committee and each country’s supervision institutions constitute the European System of Financial Supervisors– ESFS whose main responsibility is making the related uniform industry supervision rules, for example, the Single Rulebook of the banking industry and coordinating the supervision action of each country.[72]

2. Setting a single supervision mechanism

At the same time, EU set up the European Systemic Risk Council– ESRC which is devoted to providing information, precaution, suggestion and assistance for macroprudential supervision at EU level with Director of European Central Bank as chairman of the committee.[73] This committee means that EU has begun the construction of financial macroprudential supervision system, though it does not change from the fundamental the previous discrete supervision system.

The birth of the single supervision mechanism of European banks utterly changed the situation. This mechanism is composed of the European Central Bank and the supervision institutions of participating countries, covering all the banks in the Euro zone. They fulfill the prudential supervision responsibility, including issuing and writing off bank license and supervising and early warning of equity transfer, leverage ratio, large credit, liquidity, debt rate, disclosure of related information, capital adequacy ratio, internal management mechanism and procedures to maintain the financial stability of EU/Euro zone. [74]

The European Central Bank is the core of this mechanism. Compared to other institutions, it has enough technical measures (for example, monetary policy-based information gathering and liquidity used for crisis management) to fulfill its supervision function. So in many countries, the central bank takes the responsibility of macroprudential supervision. At the same time, since European Central Bank established, it has accumulated rich experience and professional knowledge in banking supervision and maintaining the stability of financial market through its subordinate committee on banking supervision. It is also the observer of Basel Committee on Banking Supervision– BCBS.[75] Moreover, Clause 6, Article 127 of the TFEU provides the legal basis for European Central Bank’s implementation of prudential supervision.[76] And to avoid the contradiction of its financial supervision function with monetary policy-making function, the interior of European Central Bank will set up a specialized supervision committee which is composed of a chairman, a vice-chairman (member of the executive committee of the European Central Bank), four representatives from European Central Bank and a representative from each of the participating countries’ supervision authority. Voting will obey the simple “majority principle” and when there is same number of dissenting votes and affirmative votes, the chairman has the say.

On principle, the European Central Bank has the supervision authority over all the credit institutions of EU member countries who participate in this mechanism, but to ensure supervision flexibility, apart from being directly responsible for issuing and writing off all the banks’ license and the stock right transfer, it only directly supervises large or systemically important banks that meet certain conditions. These conditions include owing an assent of over 30 billion euros or over 20%’s share in GDP, or large percentage of cross-border business. Other banks are still supervised by their own country, but still European Central Bank makes the final decision.

Under this mechanism, the member countries have actually handed over the banking supervision right to EU level, which means that the old discrete supervision system has fallen apart and the banking supervision system that pays attention to financial system stability has hence established. In the background of high banking integration, EU gave up the right to supervise the banks of member countries (i.e., the “home country control” principle) and chose to maintain the stability of financial system (i.e., the “prudential supervision” principle); this is huge transition of EU’s financial supervision concept and mode: for the systemically important large credit institutions that may cause financial fluctuation, the new banking supervision system adopts the functional mode (that is the European Central Bank taking charge of macro and micro prudential supervision and the member countries of business conduct supervision) so as to rapidly and effectively maintain financial market stability; for small and medium-sized credit institutions, the integration mode is adopted (that is the European Central Bank taking charge of macroprudential supervision and the member countries of microprudential supervision and business conduct supervision) so as to more flexibly guarantee the safety of credit institutions and maintain banks’ customers’ interests. This is no doubt huge innovation in the financial supervision mode itself.

V. Conclusion and Outlook

In the bank-oriented financial system of EU, banking sector takes the critical role, so success or failure of banking supervision determines whether the financial market is stable or not. The “minimum stands and home country control under mutual recognition” principle adhered by EU has on the one hand greatly pushed the integration process of EU banking sector, but on the other hand laid the foundation for a discrete banking supervision system. With the deepening of banking integration, relation between EU credit institutions is getting closer, instability risk of financial market more evident and EU banking supervision is severely challenged by “Trilemma”— which means stable financial system, integrated financial system and member countries taking charge of financial supervision cannot be achieved at the same time. In face of the reality that the banking industry has been highly integrated, EU needs to make a choice between whether to continue to maintain the right of banking supervision or to maintain the stability of financial system.

Pushed by the European debt crisis, the concept and mode of European banking supervision have made a fundamental change from “home country control” principle to “prudential supervision” principle. The member countries handed over the banking supervision right to EU level to maintain a stable financial system. The detailed measures are: European Banking Authority is responsible for making single rules; the single supervision mechanism of European banks with European Central Bank as the core is responsible for prudential supervision of banks, and cooperated with the European Systemic Risk Committee, jointly maintain financial system stability. Under the peculiar political structure of EU, the single supervision mechanism of European banks creatively draws on the strengths of existed financial supervision mode to balance stability and efficiency of financial system. This is another proof that the integration process of Europe has consistently stimulated the innovation consciousness of Europeans and spurred them to action.

After the landing of single supervision mechanism of European banks, the vicious circle of banking crisis and sovereign debt crisis is uprooted from the mechanism by injecting into problem banks by the ESM. Meanwhile, this laid the foundation for the establishment of Banking Union, to which the Single Resolution Mechanism– SRM and Single Deposit Insurance Scheme would be the next duty of EU. In fact, forming a uniform banking supervision system is an inevitable choice during the process of Europe pushing forward integration, and is also an important opportunity created by the European Debt Crisis. What’s more, the issue of fiscal integration closely related to this, e.g., the issue of Fiscal Union will also be gradually put on the agenda. From a more macro perspective, the establishment of European single banking supervision mechanism is providing an important reference for international financial supervision reform on how to solve the global-level Trilemma problem

The ECB will assume its new banking supervision responsibilities in November 2014, 12 months after the SSM Regulation enters into force.[6] Now it’s our turn to ask, is this “perfection” of the old banking supervision mode of EU or does it mean the “transformation” of its supervision mode and idea? If it’s transformation, what’s the incentive behind it? And compared with the old one, what features does the new supervisory system have? To answer these questions, we have to sort out the old banking supervision system of EU which has a lot to do with the integration process of EU banking market.

I. The Integration Process of EU Banking Market Prior to the European Debt Crisis

In 1951, the then French foreign minister Robert Schuman proposed to initiate the European Coal and Steel Community – ECSC, which is the first actual step to turn European economic integration into reality. [7] In 1957, the Treaty of Rome was signed and the European Economic Community—EEC, whose main goal was to set up a European common market where goods, services, labor and capital can freely flow--was established, laying the foundation for integration of EU financial service market.[8]

The financial system of EU countries (with Britain excluded) is bank-oriented. Banks are systemically important characters due to its function of providing fluidity to enterprises and other financial institutions in the market. Statistics suggest that from 1995 to 2004, the average ratio of bank credit of EU-25 to their GDP is 109.2%, with EU-15 as high as 114.6%; while this index of America and Japan is only 40.7% and 79.7% in 2001[9]. So it’s since the beginning that EEC/EU has adopted the bank-oriented financial integration policy.

1. The related polices to push forward EU banking integration

To push forward the integration process of banking within the region, EEC/EU successively took the following measures.

1.1 Eliminate the access barriers

With regard to the then access barriers exist in each country, EEC implemented the “national treatment principle” within the region, i.e., all the financial institutions of a country, no matter whom they belong to, are subject to the same regulations and supervision. In June 1973, the Council of the European Communities issued The Abolition of Restrictions on Freedom of Establishment and Freedom to Provide Services for self-employed Activities of Banks and other Financial Institutions, thus clearing the way for EEC countries to run banking business in one another. [10]

1.2 Coordinate the supervision rules

After the market access barriers are eliminated, the banks of EEC countries can take up and pursue business in each other, but due to each member country’s different banking supervision rules, the costs of cross-border banking operations are greatly increased. Since the differences between the supervisory modes of member states cannot be immediately eliminated, EEC adopted the “minimal harmonization” policy so as to reduce the resistance to integration of banking sector. [11] In 1977, the EEC council released First Council Directive on the coordination of laws, regulations and administrative provisions relating to the taking up and pursuit of the business of credit institutions, i.e., First Banking Directive, starting the coordination process of supervisory rules of European banks. [12] In 1989, the Council of EEC published the Second Banking Directive, which furthered each country’s supervision rules like the capital adequacy ratio standards, large loans regulations and banks’ eternal rights to participate in the supervisory coordination of non-financial sector business. [13]

1.3 Determine the limits of supervisory authority

The issue of whether the related banks are supervised by host states or home states came up with the advent of cross-border operations of banks. Actually, ambiguity of supervisory authority will bring great concern to bank supervisors and banks themselves and hamper the normal cross-border operations of banks. In 1985, with the deepening of coordination of supervisory rules, Commission of the European Communities submitted the white paper “Completing the Internal Market” to European Council, stating the plan to perfect the single market by the end of 1992, and raised the principles of single banking license, home country control and mutual recognition in relation to banking supervision.[14] These principles are manifested in the Second Banking Directive. According to this directive, rights of prudential supervision is granted to the bank’s home state, which means that once gaining approval of one country, the banks of EEC member states can provide cross-border financial service or set up branches in all other member states (branches mean the subsidiaries registered in other member states according to the local laws and regulations whose home state is right the place where it’s registered). At the same time, the “host country” has the obligation to protect the public interest of its people, so it will carry out conduct-of business supervision to protect the interests of bank customers.[15] These rules clearly set the boundary of banking supervision authority and paved the way for mixed operations of EEC/EU. [16]

1.4 Break down the supervision and market barriers

After making clear the relationships between the organizations of banking sector, EEC/EU started to break down the supervision and market barriers to promote the free flow of regional capitals and supply of cross-border financial service of banks. The main measures include:

(1) The Directive on Liberalization of Capital Flows issued in 1988 requiring canceling all foreign exchange control and capital flow restrictions.[17]

(2) Directive on Deposit Guarantee Schemes[18] passed by EU council in 1994 which brought in the compulsory deposit insurance for all EU financial institutions.[19]

(3) The consensus reached by European Council based on the Delors Report in terms of establishing Economic and Monetary Union on three steps.[20] This plan was written into Maastricht Treaty which was signed in 1991.[21] In 1999, the common currency—Euro was born and all the countries that joined the Euro zone should share the same currency, monetary policy and central bank. Up to January 1st, 2011, there were 17 EU member countries using euro.[22] Meanwhile, the Trans-European Automated Real-time Gross Settlement Express Transfer (Target) started to be used. [23]

(4) In 1999, to match up the new money - euro, European Commission issued the Financial Services Action Plan- FSAP which includes a series of measures to promote the total integration of banking industry and capital market.[24] This plan was based on Markets in Financial Instruments Directive- MiFID that aims at facilitating investors taking cross-border activities within Europe.[25]

2. Integration of the EU banking sector prior to the European debt crisis

Pushed by different measures like the above-mentioned ones, the banking sector of EU (especially the euro zone) is getting more and more integrated.

2.1 Price-based indicators

According to “law of one price”, the trend of convergence of bank asset prices or returns (i.e., interest rates) can lead, to a certain extent, the deepening of banking integration. Before the European debt crisis, the wholesale banking business of EU like inter-bank borrowing, government bonds, investment banking and various financial derivative markets have been highly integrated: the return rates of the monetary market and government bonds (especially for the Euro zone countries) had been nearly totally converging (Figure 1); that of enterprise bonds is more influenced by a variety of common factors and hardly influenced by the environment of its local country (Figure 2). [26] Though retail banking business is slow in the process of integration due to the limitation of various elements[27], it does have an obvious trend of interest rate converging.

2.2 Quantity-based indicators

The integration of banks also means the increase of various cross-border businesses of credit institutions. From the year 1995 to 2006, EU banking sector’s average cross-border penetration index rose from 11% to 19%.[28] Among the 30 biggest EU banks[29], the number of European Bank rose from 7 in 2000 to 11 in 2005, while Domestic Bank and Global Bank were respectively reduced in number by 2.[30] At the same time, mergers and acquisitions of EU banks (and financial transaction market) drew people’s attention; this was because, on the one hand, the integration-pushing measures and policies of EU intensified the competition between banks, which resulted in banks (and financial exchange market) seeking for strengthening competitiveness by mergers and acquisitions; on the other, these measures and polices did create opportunities for banks (and financial exchange market) for cross-border merger and acquisition—especially since the start of EMU, mergers within EU have been booming (Figure 4) and credit institutions constantly decreasing in number.[31]

2.3 Summary

As an important part of the economic integration, integration of EU financial sector is deepening under the push of EEC/EU. And because of the bank-oriented feature of its financial system, the integration course of banks is no doubt taking important place. In this process, the cost and returns of capital of member states are tending to be the same, cross-border banking business is growing, and the relationship within EU banking industry is getting close with the impact on each other tightening and the overall industry revealing a high level of integration.[32]

II. EU Banking Supervisory System Prior to the European Debt Crisis

The policies put forward by EEC/EU for promoting the integration of banking sector are in themselves the adjustment and construction of supervisory system based on different levels of banking integration, and their core idea is the “home country control combined with minimum standards and mutual recognition” principle. Under this guiding principle,[33] the EU banking supervisory system before the European debt crisis had the following characteristics:

1. Discrete supervision structure

In general, banking supervision contains three dimensions which are macroprudential supervision, microprudential supervision and business conduct supervision. The function of macroprudential supervision is coping with systemic risk so as to maintain the whole financial system’s stability, or to avoid financial shock imperiling the real economy; while the aim of microprudential supervision is to ensure well functioning of credit institutions so as to render them solvent. These two supervision modes are called prudential supervision in general[34], which are mainly realized by monitoring, alarming for and controlling capital adequacy rate, liquidity and risks and crisis management.[35] For business conduct, it’s mainly dedicated to realizing the equality and integrity of the market to guarantee the benefits of bank customers.[36] In supervision practice, these three dimensions are closely related: sound commercial behavior supervision can raise the prestige of credit institutions and reduce their operating risks while solvent credit institutions can at most times reduce the systemic risk of financial market. The vice versa: the stable financial market can provide good operating environment to credit institutions while ensuring and improving the solvency of credit institutions also means protecting the rights and interests of bank customers.

Second Banking Directive respectively confers (micro)prudential supervision rights and business conduct supervision rights on home country and host country while section 5, article 105 of Maastricht Treaty explicitly states that member countries have the authority over micro and macro prudential supervision of banks, [37] which lays a legal footing for the discrete model of EEC/EU banks’ supervision system. Under this system, the bank supervision rights are reserved to member countries, i.e., member country is responsible for macro and micro prudential supervision while the host country is responsible for bussiness conduct supervision.

2. Diverse supervision models and rules

According to the difference of organizational structure, financial supervision mechanism can be divided into traditional sector model and cross-sector model that occurs with the increase of mixed operation; cross-sector model can be further divided into functional model and integrated model.[38] Under the functional model, prudential supervision and business conduct supervision are respectively taken charge of by two institutions independent of each other. The advantage of this model is that it does not separate the responsibility of macroprudential supervision and that of microprudential supervision, which can help cope with financial risks more rapidly and effectively. While under the integrated model, a certain institution is responsible for business conduct supervision and microprudential supervision, and macropurdential supervision of the financial system is taken charge of by another institution. This model’s advantage is that the credit organization needs only to communicate with one supervision institution, which makes supervision more flexible and efficient. In fact, these two mixed operation models have their own strength for which each other is lacking. Because of different development path, financial supervision models within European countries are different to each other.[39] Up to 2006, there are 9 countries using the traditional sector supervision model, 4 using functional supervision model and 14 using integrated supervision model (table 1).

In addition to this, under the guidance of “home country control combined with minimum coordination” principle, the supervision rules and practices of European countries are also diverse from each other, for instance the definition of the credit institutions and the important supervision indicators such as core capital and Shareholder’s equity, Procedure of the asset evaluation, risk assessment and deposit insurance, content and practice of the regulation rule. [40]

3. Supervision cooperation and coordination system

With the integration of EU banking industry going further, cross-border business of banks is increasing, and cooperation and coordination of banking supervision within member countries of EU starts to occur. There are two main ways for this: one is through signing bilateral or multilateral memorandum of understanding to ensure effective daily supervision of credit institutions that undertake cross-border businesses; the other is setting up various committees at EEC/EU level to coordinate the supervision of rules and practice so that a fair competition environment is created for the credit institutions in the region.[41]

As early as in 1972, the member countries of EEC set up Groupe de Contact – Gdc to promote the communication of banking supervision information between the supervision institutions, and cooperated in real supervision practices. In 1978, EEC initiated the Banking Advisory Committee – BAC to provide consultancy for the issue of supervision rules.[42] In 1998, Banking Supervision Committee was set up in European System of Central Banks – ESCB so that the system can fulfill the related legal tasks in matters of banking supervision and maintaining the stability of financial market. This Committee can also provide consulting service to the banking supervision institutions of each country.[43]

In 2002, under the guidance of Financial Services Action Plan, EU started to build a systemic supervision cooperation and coordination system, i.e., the Lamfalussy Framework. This Framework has four levels:

——The first which consists of EU Counsel, European Commission and European Parliament, is responsible for making financial supervision-related Directives and Regulations through normal legislative procedures at EU level;

——The second which in the banking supervision field is mainly EBC, is responsible for making detailed technical measures that are congenial to market development;

——The third level is for promoting the cooperation and connection of each country’s supervision institutions on the legal basis of the previous two levels and is taken charge of by the Committee of European Banking Supervisors – CEBS, whose main measures include offering interpretative recommendations, fulfilling guidelines of legal provisions and common standards that are not covered by the above two levels and recommending the optimum regulatory practices based on assessment and comparison; and

——The fourth level is performing duties in cooperation with related institutions of EU and its member states. Before the European debt crisis, this framework is the main tool for banking supervision cooperation and coordination of EU (Figure 5).[44]

4. Summary

Before the European debt crisis, the banking supervision system obeyed the “home country control combined with minimum standards and mutual recognition” principle and basically did not change the existing banking supervision system so as to promote the integration process of EU banking industry as early as possible. Under the guidance of this principle, the supervision system of EU banks reveals a discrete characteristic, i.e., each member state relying on their own with their supervision model and rules different from each other. To meet the challenge of integration, EU tried to set up a series of institutions and frameworks to realize effective coordination and cooperation of supervision.

With the deepening of banking integration, especially after the introduction of euro, the relation between the financial markets of EU countries is strengthening with the increasing vulnerability of EU financial market.[45] Some people started to call for building a single supervision institution for the banking industry at EU level to maintain the stability of financial market. But EU thinks that the existing different banking supervision models and rules of member states are gradually formed in the long-term development, fit for each country’ national conditions, and compared with the single supervision mechanism at EU level, this discrete supervision system can exert more effective and flexible supervision on each country’s banks; as to the issues of financial market stability and risk management brought by the deepening of integration, they can be solved by prudential supervision by member countries and their further coordination and cooperation under the Lamfalussy Framework.[46] Moreover, banking supervision involves the sovereignty of member countries and is not an purely economic issue; the banking supervision system currently can be said to be political optimal.[47] However, this opinion was totally overwhelmed by the impact of the European debt crisis.

III. The European Debt Crisis and Supervision Dilemma of EU Banks

1. The European debt crisis

From 2005-2006, the American real estate bubble shattered. In November 2006, the real estate price began to fall and the risk of subprime mortgage was getting obvious. In March 2007, the serious bad debt issue of subordinated debt of New Century Financial Cooperation, the second biggest subprime lending corporation in America, was disclosed, which caused investors to lose confidence in mortgage securities and market to be in a panic, starting America’s Subprime Mortgage Crisis in 2007. In September 14th, 2008, Lehman Brothers Holding Inc filed for bankruptcy, and in the same day, Merrill Lynch was purchased by Bank of America, causing global stock market slump. The crisis spread rapidly worldwide and gave rise to credit squeeze and liquidity shortage, changing American Subprime Crisis into international financial crisis and plunging the global financial market into concussion.[48]

This crisis also brings huge impact on European financial market. Early in September 2007, the fifth biggest credit institution in Britain, Northern Rock, met a dilemma because of liquidity shortage due to stagnation of international financing market. [49] Furthermore, after the outbreak of international financial crisis, the main mortgage bank of Britain, Bradford & Bingley; the biggest bank of Spain, Grupo Santander; Fortis of Holland, Belgium and Luxembourg; the second biggest mortgage bank of Germany, Hypo Real Estate; the third biggest bank of Iceland, Glitnir; Dexia of France and Belgium; six large banks of Ireland such as Allied Irish Banks and Bank of Ireland; and UnitCredit of Italy and many banks of Greece and Central and Eastern Europe immediately got into difficulty of liquidity.

With the crisis expanding and fermenting, more and more European banks encountered the problem and even their real economy is affected. To maintain the stability of financial system and curb recession of macro economy, the governments of European countries took a series of bailout measures which include nationalizing problem banks[50], providing deposit guarantee[51], direct asset injection[52] and economic stimulus package, but these also increased the burden on public finance and caused market’s concern about the discontinuity of public finance in some countries[53], which finally ignited the sovereign debt crisis.[54] Since the banks of European countries were holding a lot of problem national bonds at hand, there was panic in the market about sovereign debt default leading to write-down of bank portfolio, inter-bank borrowing and market liquidity greatly shrank and the financial market was once again in concussion and finally evolved into a vicious circle of sovereign debt crisis and banking crisis. The EU/Euro zone’s financial market was on the verge of breakdown.

2. Trilemma of European bank supervision

Though the financial market of EU/Eurozone is getting stable with the introducing of Outright Monetary Transactions – OMTs and European Stability Mechanism – ESM, [55] crisis has shown that under the highly integrated EU banking industry background, the discrete EU banking supervision system that conforms to the “home country control principle” cannot effectively maintain the stability of EU financial market. This is because:

First, the deepening of integration of EU banking industry has stepped up the competition between banking institutions.

Under the discrete supervision system of “home country control”, the member countries, in order to strengthen their homeland financial industry’s competency, compete to relax the supervision on their homeland banks. Low interest rate, sufficient liquidity and easy credit approval directly lead to EU especially Eurozone’s excess expansion of loan issuing.[56] In January 1998, the total amount of credit and money supply of Eurozone, M3, were respectively 7.1976 trillion and 4.2405 trillion while in December 2008, they grew to 15.5341 trillion Euros and 9.4011 trillion Euros—both amounts of increase more than doubled.[57] Over the same period, GDP rose from 6.1689 trillion to 9.2416 trillion Euros, increased by only less than half.[58] In 2008, the leverage ratios of the major banks of EU were generally at 35 with that of Deutsche Bank as high as 52. Contrary to this, even the major banks in America had a leverage ratio at the same period of below 20.[59] The excess expansion of the assets of European banking industry and too high leverage ratio caused the EU financial market to be in lack of risk tolerance when confronting the outside impact (e.g., the liquidity and credit squeeze resulted from the subprime crisis), which sowed the seeds of European debt crisis.

Secondly, since the European financial market has been highly integrated, the multinational banks can make policy and participate in activities on EU basis, but under the discrete supervision system, each country can only supervise on national level, which provides the possibility that the multinational banks utilize the difference between supervision rules and practice to evade supervision and acquire the biggest benefit.[60]

At the same time, under the principle of “home country control”, the host country has no authority over the branches[61] of foreign banks within its border; even if it can supervise, it cannot effectively avoid the impact of mismanagement of parent company on its financial market, because the host country has no right to supervise the parent company while the activities of branch companies are unavoidably influenced by parent company’s decision making and activities.[62] This has been fully proved by the banking crisis of Iceland in 2008.[63] From this we can see that in the context of highly integrated banking industry and frequent cross-border activities of various kinds, the member countries have no way to exert effective macroprudential supervision on their banking industry to maintain a stable financial market. So it’s understandable that for the new member countries of EU that have a high ratio of foreign assets in their whole banking assets, their banking industry and financial markets were first affected by the world financial crisis and caught in undulation.[64]

Thirdly, high integration of EU banking industry has resulted in continuing strengthening of the correlation of financial markets, whereas, under the discrete supervision system, there is no supervision institution that is responsible for the whole area’s financial stability because the supervision institutions of member countries are merely focusing on the safety of their homeland’s financial institutions and market, which does not necessarily lead to financial market’s stability.

In particular, when a country’s financial industry’s interests is in conflict with EU as a whole (or other member countries), the supervision authority of that country may put its national interest over EU (or other member countries) and stop the nascence of common solutions, which will cause dilemma for collective action.[65] After the outbreak of sovereign debt crisis, liquidity started to contract, financial system risk increased and the banking supervision departments of European countries successively imposed stricter requirements on capital adequacy ratio of their country so as to avoid crisis’ impact on homeland banks and financial market. But, this has resulted in severe shrinkage of inter-bank lending market: various banks would like to deposit money in European Central Bank, which, on the contrary, intensified liquidity shortage and amplified the risk in European financial market.[66]

Fourthly, in the context of banking integration, stable and systemically important multinational banks are emerging in the market, and when they are in crisis, the discrepancy of supervision rules and practice of member countries under “home country control” will affect the crisis management effect of banks; on the other hand, the portfolios of banks are rapidly expanding, so if the banking industry of a country is in crisis, a single member country (for example, Spain) may lack of ability to bail it out, while under the “home country control”principle, EU does not have the corresponding mechanism to implement single crisis management, which makes them unable to timely and effectively cope with crisis and the EU financial system more unstable.[67]

Fifthly, under the Lamfalussy Framework, cooperation and coordination have been proved to be unable to solve the above problem. Under the “home country control” principle, in light of the difference between legislation principle and technical rules of each country, EU usually issues the first level of law in the form of Directives[68], which gives room for member countries to implement and leads to the fact that a single text of terms cannot be formed on the third level. What’s more, since these texts themselves are not legally binding, the member countries have the right to choose whether to adopt or not. Speaking of this, this framework cannot eliminate the huge discrepancy between the supervision rules and practice of each member country, and adding that it is the member countries that hold the real banking supervision rights and EU does not have a coercive coordination organization, when on the fourth level of implementation, it’s hard to realize effective and efficient coordination and cooperation, especially when there is conflict of interest between member countries or a member country and EU.[69]

In summary, in the background of highly integration of EU banking industry, the discrete banking supervision system cannot guarantee a stable EU financial system but even adds risk to financial market, and after the outbreak of crisis, it cannot help realize timely and effectively crisis management. These problems have been fully manifested in the European debt crisis. So the European banks are facing a “Trilemma”, i.e., a stable financial system, an integrated financial system and national financial supervision cannot be acquired at the same time.[70] In face of the fact that the banking industry has been highly integrated, EU is bound to whether stick to “politically” correct policy, i.e., reserves the banking supervision rights to member countries and ignores the risk of a fluctuating financial market, or change the governing mode, i.e., let each country hand in the banking supervision rights and build a single regional supervision mechanism to maintain the stability of financial market.

IV. Transformation and Innovation in EU Banking Supervision Model

Influenced by the crisis, there is fundamental change in the concept and model of banking supervision of EU, i.e., they do not focus on whether taking the banking supervision rights from member countries or not but on maintaining the stability of financial system, i.e., turning from the “home country control” principle to “prudential supervision”.[71] Their main thoughts are: 1. making a single supervision rule that has more operability and coerciveness to maximize the convergence of supervision rules of member countries so that they can better coordinate and cooperate; 2. In light of the key place European banks take in its industry, set up a pan-European banking supervision organization to implement macroprudential supervision to maintain the stability of financial system.

1. Making a single regulation rule

In 2009, EU decided to establish three financial supervision bureaus on the basis of the third-level institutions under the Lamfalussy Framework, i.e., European Banking Authority– EBA which is formerly known as CEBS, European Insurance and Occupational Pensions Authority– EIOPA which is formerly known as Committee of European Securities Regulators– CESR and European Securities Authority– ESA which is formerly known as Committee of European Securities Regulators– CESR. These three organizations together with the Steering Committee and each country’s supervision institutions constitute the European System of Financial Supervisors– ESFS whose main responsibility is making the related uniform industry supervision rules, for example, the Single Rulebook of the banking industry and coordinating the supervision action of each country.[72]

2. Setting a single supervision mechanism

At the same time, EU set up the European Systemic Risk Council– ESRC which is devoted to providing information, precaution, suggestion and assistance for macroprudential supervision at EU level with Director of European Central Bank as chairman of the committee.[73] This committee means that EU has begun the construction of financial macroprudential supervision system, though it does not change from the fundamental the previous discrete supervision system.

The birth of the single supervision mechanism of European banks utterly changed the situation. This mechanism is composed of the European Central Bank and the supervision institutions of participating countries, covering all the banks in the Euro zone. They fulfill the prudential supervision responsibility, including issuing and writing off bank license and supervising and early warning of equity transfer, leverage ratio, large credit, liquidity, debt rate, disclosure of related information, capital adequacy ratio, internal management mechanism and procedures to maintain the financial stability of EU/Euro zone. [74]

The European Central Bank is the core of this mechanism. Compared to other institutions, it has enough technical measures (for example, monetary policy-based information gathering and liquidity used for crisis management) to fulfill its supervision function. So in many countries, the central bank takes the responsibility of macroprudential supervision. At the same time, since European Central Bank established, it has accumulated rich experience and professional knowledge in banking supervision and maintaining the stability of financial market through its subordinate committee on banking supervision. It is also the observer of Basel Committee on Banking Supervision– BCBS.[75] Moreover, Clause 6, Article 127 of the TFEU provides the legal basis for European Central Bank’s implementation of prudential supervision.[76] And to avoid the contradiction of its financial supervision function with monetary policy-making function, the interior of European Central Bank will set up a specialized supervision committee which is composed of a chairman, a vice-chairman (member of the executive committee of the European Central Bank), four representatives from European Central Bank and a representative from each of the participating countries’ supervision authority. Voting will obey the simple “majority principle” and when there is same number of dissenting votes and affirmative votes, the chairman has the say.

On principle, the European Central Bank has the supervision authority over all the credit institutions of EU member countries who participate in this mechanism, but to ensure supervision flexibility, apart from being directly responsible for issuing and writing off all the banks’ license and the stock right transfer, it only directly supervises large or systemically important banks that meet certain conditions. These conditions include owing an assent of over 30 billion euros or over 20%’s share in GDP, or large percentage of cross-border business. Other banks are still supervised by their own country, but still European Central Bank makes the final decision.

Under this mechanism, the member countries have actually handed over the banking supervision right to EU level, which means that the old discrete supervision system has fallen apart and the banking supervision system that pays attention to financial system stability has hence established. In the background of high banking integration, EU gave up the right to supervise the banks of member countries (i.e., the “home country control” principle) and chose to maintain the stability of financial system (i.e., the “prudential supervision” principle); this is huge transition of EU’s financial supervision concept and mode: for the systemically important large credit institutions that may cause financial fluctuation, the new banking supervision system adopts the functional mode (that is the European Central Bank taking charge of macro and micro prudential supervision and the member countries of business conduct supervision) so as to rapidly and effectively maintain financial market stability; for small and medium-sized credit institutions, the integration mode is adopted (that is the European Central Bank taking charge of macroprudential supervision and the member countries of microprudential supervision and business conduct supervision) so as to more flexibly guarantee the safety of credit institutions and maintain banks’ customers’ interests. This is no doubt huge innovation in the financial supervision mode itself.

V. Conclusion and Outlook

In the bank-oriented financial system of EU, banking sector takes the critical role, so success or failure of banking supervision determines whether the financial market is stable or not. The “minimum stands and home country control under mutual recognition” principle adhered by EU has on the one hand greatly pushed the integration process of EU banking sector, but on the other hand laid the foundation for a discrete banking supervision system. With the deepening of banking integration, relation between EU credit institutions is getting closer, instability risk of financial market more evident and EU banking supervision is severely challenged by “Trilemma”— which means stable financial system, integrated financial system and member countries taking charge of financial supervision cannot be achieved at the same time. In face of the reality that the banking industry has been highly integrated, EU needs to make a choice between whether to continue to maintain the right of banking supervision or to maintain the stability of financial system.