-

- Dan Steinbock

- Non-resident Scholar

- SIIS

- [email protected]

- The Tragedy of More Missed Opportunities

The Tragedy of More Missed Opportunities

- The Tragedy of Missed Opportunities

The Tragedy of Missed Opportunities

- The odd war with WHO’s battle against Covid-19

The odd war with WHO’s battle against Covid-19

- Toward Virus Crossroads

Toward Virus Crossroads

- How Failed Int’l Cooperation Amplifies Virus Damage

How Failed Int’l Cooperation Amplifies Virus Damage

- WHAT IF CLINTON WINS ——US President...

- BRICS can lead Global South

- China’s Foreign Policy under Presid...

- China’s Foreign Policy under Presid...

- ‘Belt and Road’ initiative must wor...

- Criticism of CPEC is proof of progr...

- The Contexts of and Roads towards t...

- Seeking for the International Relat...

- Seeking for the International Relat...

- Beyond the Strategic Deterrence Nar...

- The Belt and Road Initiative and Th...

- Wuhan 2.0: a Chinese assessment

- The Establishment of the Informal M...

- Identifying and Addressing Major Is...

- Identifying and Addressing Major Is...

- “Polar Silk Road”and China-Nordic C...

- Commentary on The U. S. Arctic Coun...

- China’s Economic Initiatives in th...

- Perspective from China’s Internatio...

- Identifying and Addressing Major Is...

- BRI in Oman as an example: The Syn...

- Coronavirus Battle in China: Proces...

- China’s Fight Against COVID-19 Epid...

- Revitalize China’s Economy:Winning ...

- International Cooperation for the C...

- Working Together with One Heart: P...

- The Tragedy of Missed Opportunities

- The Tragedy of More Missed Opportun...

- The US Initiatives in Response to C...

- China-U.S. Collaboration --Four cas...

With the novel coronavirus – the 2019 novel coronavirus acute respiratory disease – the dark milestone of 100,000 confirmed cases will soon be broken, while the number of deaths exceeded 3,000 already at the turn of March. The good news is that the number of the recovered will soon soar to more than 50,000 as well.

The bad news is that, even though virus challenges should continue to ease toward April, the acceleration of new cases outside China is only beginning and likely grossly under-reported. Consequently, the number of confirmed cases worldwide, including the distribution of those cases (Figure 1), is likely to climb in the future.

Figure 1 Distribution of COVID-19 Cases*

Source: World Health Organization, National Health Commission of the People’s Republic of China. Map Production: WHO Health Emergencies Program * As of March 4, 2020. Simplified

What makes it challenging to project the global future of the new coronavirus is that even though the epidemic has already touched more than 60 countries, it is showing some signs, however fragile, that it could be contained over time.

Containing the spread in China

The novel coronavirus was first detected on December 30, 2019 (hence the technical name 2019-nCoV ARD), when three bronchoalveolar lavage samples were collected from a patient with pneumonia of unknown etiology. In the process, Wuhan Jinyintan Hospital followed a surveillance definition established after the SARS outbreak of 2002-2003. The “mystery pneumonia,” as it was then called, had a close relationship with a bat SARS-like coronavirus strain.

According to the World Health Organization (WHO), the prevention and control measures in China were implemented rapidly, from the early stages in Wuhan and key areas of Hubei, to the national epidemic. Here’s how it happened.

On January 1, the Huanan seafood wholesale market in which the virus may have originated or which amplified the spread or both, was closed. On January 3, gene sequencing was completed by China’s Center for Disease and Control (CDC); four days later, CDC isolated the novel coronavirus. On January 10, it publicly shared the gene sequence of the virus. And by mid-month, China’s National Health Laboratory (NHC) issued diagnosis and control technical protocols.

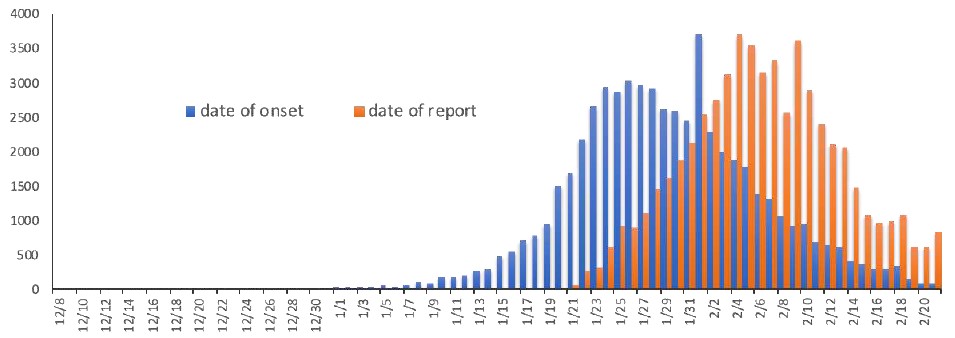

After the detection of the cluster of pneumonia cases in Wuhan, the Chinese Communist Party Central Committee and State Council launched the national emergency response, led by General Secretary Xi Jinping, Prime Minister Li Keqiang and Vice Premier Sun Chunlan. As documented by the recent WHO China Joint Mission, the epidemic grew dramatically around January 10 to 22. Thanks to China’s draconian measures, reported cases peaked and plateaued between January 23 and 27, and have steadily declined since then, apart from one spike (Figure 2).

Figure 2 Epidemic Curves for Confirmed COVID-19 Cases in China

* By symptom onset and date of report (February 20, 2020) for laboratory confirmed cases in China. Source: WHO China Joint Mission, Feb 29, 2020

In the early 2000s, China’s efforts to control SARS were criticized as the disease spread internationally before the global outbreak was subdued. Only a decade later, Chinese response to the Avian influenza (H7N9) was significantly faster, broadly praised and the disease did not spread widely. With COVID-19, WHO’s chief Dr. Tedros Adhanom Ghebreyesus has stated that China should be credited with identifying the virus in “record time,” sharing its genetic sequence quickly, and flagging potential international spread.

This is how it happened: In the most agile and aggressive disease containment effort in history, China first promoted universal temperature monitoring, masking, and hand washing. As the outbreak evolved and knowledge was gained, it adopted a science and risk-based approach to tailor implementation. In the final phase, specific containment measures were adjusted to the provincial, county and even community context, the setting, and the transmission there.

Nevertheless, when China’s central government imposed the cordon sanitaire around Wuhan and neighboring municipalities on January 23, 2020, it was criticized as a sign of “Beijing’s autocratic measures” that would not help but could make the crisis a lot worse. In reality, these measures effectively prevented further exportation of infected individuals to the rest of the country. That’s why the Chinese blueprint is now used around the world as foreign governments seek to use the lessons to tailor their own containment measures.

It was this massive quarantine of tens of millions of people that delayed the export of the outbreak not just to the rest of China but abroad. Unfortunately, much of that advantage was missed in slow international mobilization.

International delays and challenges

At the end of January, the WHO declared the ongoing virus outbreak a “public health emergency of international concern” (PHEIC). The WHO was concerned about the possible effects of the virus, if it would spread to countries with weaker healthcare systems. On February 4, Dr. Tedros dropped a news bomb by stating publicly that it was not China, but countries outside China that had proved slow in sharing information about cases. After a month of international crisis and global alert, three of five member countries had failed to provide adequate information to WHO. Those reports were vital to assess the international scope of the outbreak and to contain it.

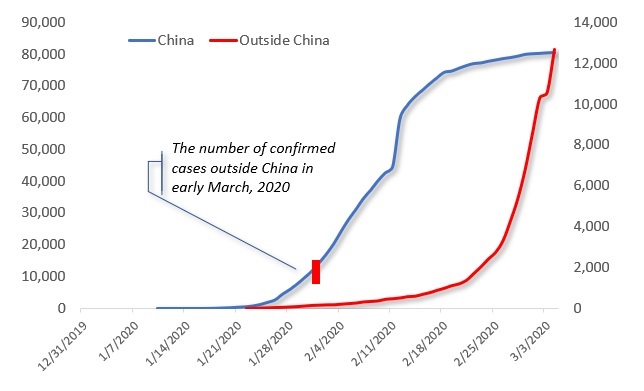

As the timeline suggests, the number of cases outside China soared after February 4 and the missed opportunities for greater international cooperation (Figure 3).

Figure 3 COVID-19 international risks have soared since early February*

* Epidemic curve of confirmed COVID-19 cases outside of China through March 2, 2020 Source: WHO, Difference Group.

Moreover, in the past, the US has often boosted international collaboration against common threats but that wasn’t the case now. The Trump cabinet’s efforts to exploit the crisis in the trade war were exemplified by Commerce Secretary Wilbur Ross. On January 30, after the ‘Phase 1’ trade deal, Ross declared the virus in China would benefit the US. The politicized attacks were reflected by Secretary of State Mike Pompeo and Health and Human Services (HHS) Secretary Alex Azar who blame Beijing for the crisis.

Risk of botched quarantines. On February 3, more than 3,700 passengers and crew of Diamond Princess were quarantined by the Japanese Ministry of Health after one passenger on the ship tested positive for COVID-19. Just two and half weeks later, some 635 passengers had tested positive for the virus, while two passengers has died after contracting the virus.

Risk of “super-spreaders.” With rapidly-expanding deadly viruses, super-spreaders who endanger others are a great concern. On February 10, a 61-year old woman, who worships at the Daegu cult church, developed fever but twice refused to be tested for the virus claiming she had not recently travelled abroad. Today, the number of confirmed cases in South Korea exceeds 5,000 with almost 40 deaths.

Risks of poorly-managed evacuations. As countries seek to rescue citizens from infected territories, failed evacuations can pose new risks. With Diamond Princess, the US Centers for Disease Control (CDC) urged to keep 14 infected US citizens in Japan, yet the State Department put the infected on a plane with healthy people claiming that a plastic-aligned enclosure would mitigate infection risks.

Risks of poorly-monitored self-quarantines. After mid-February, California health officials said that 7,600 people who had returned after visiting China during the virus outbreak had been asked to quarantine themselves at home. Instead of tracking by CDC, local health departments have discretion in how to carry out the quarantines.

Lack of or medical equipment. When the virus went global at the turn of March, most countries began to mobilize for supplies only belatedly. Around mid-February – the CDC found that some coronavirus test kits delivered to state laboratories were faulty. Now the plan is to start tests in US states by mid-March, although the idea of local tests was to expedite the diagnosis process.

Risks of weaker healthcare systems. Virus clusters have already emerged in every world region. The real question is how forcefully the virus will arrive in the rest of Americas and particularly Africa. Nor are developed economies immune to risks that center on inner-cities and rural margins, large prison populations and nursing homes.

Risks of untraceable virus clusters and local transmissions. As it is becoming harder to trace where the clusters started, the virus may be spreading too broadly for traditional public-health steps to contain it. Local transmission has occurred in many countries after case importation. Amid their battles against the Ebola virus and the unprecedented locust plague, many countries in Africa are struggling to step up preparedness to detect and cope with COVID-19 virus importations.

China toward rebound

After mid-January, I projected three probable virus impact scenarios in China, which can now be reassessed in light of new evidence and internationalized outbreaks. In the “SARS-like impact” scenario, a sharp quarterly effect, accounting for much of the damage, would be followed by a rebound. The broader impact would be relatively low and regional. In the “extended impact” scenario, the adverse impact would last at least two quarters. The broader impact would be more severe and have an effect on global prospects. In the “accelerated impact” scenario, adverse damage would be steeper with dire consequences in the global economy.

Recently, IMF projected global growth to fall 0.1 percentage points from the expected 3.3%. The estimate is optimistic. Even the OECD expects global GDP growth to drop to 2.4% in 2020, with possibly negative growth in the first quarter.

The big question is whether other major affected economies – US, EU/UK, Japan and large emerging countries – can achieve China-like fast containment. With the already-seen adverse impact on confidence, financial markets, travel, transportation and tourism, coupled with disruption to supply chains, multilateral development banks will soon release significant downward revisions in major economies.

The first and most benign “SARS-like impact” scenario is no longer likely. But nor is a comprehensive “extended impact” scenario inevitable if China gets back to business in March. Despite elevated warnings since mid-January, uncertainty began to grip the rest of the world only at the end of February, as evidenced by the recent multi-trillion-dollar market corrections in US and elsewhere.

While China still continues to report up to several hundred cases daily and must now guard against imported cases, economic recovery in the mainland has gained momentum since late February and is likely to intensify in the course of March.

IMF projects China’s growth to fall to 5.6% in 2020. Factory activity in China did contract at the fastest pace on record as the Purchasing Managers’ Index (PMI) fell to a record low of 35.7 from 50.0 in January. The same goes for the services activity.

Yet, both plunges were expected. Economic shocks translate to contractions. The real question involves the strength of the post-shock rebound in March.

In China, the expectation in January was that the first quarter would be penalized by a reduction of 1.2 percentage points to 5% or less, while the second quarter rebound would offset much (but not all) of the losses. March data could still prove high, given the low starting-point.

It is these assumptions of the first scenario that fuel the bold projections by J.P. Morgan that the Chinese first quarter could go down to -4%, but second quarter would go up to 15%. The rebound story is possible, if fiscal and monetary support is adequate. And if the small- and mid-size firms, which account for more than four-fifths of nationwide employment and over half of the GDP, can jumpstart production.

International damage in the 1st and 2nd quarters

Internationally, belated mobilization translates to economic uncertainty and market volatility. By early March, the number of confirmed international cases exceeded 15,000. But that’s only a prelude. In early March, the number of confirmed cases outside China is about the same as in China about a month ago. In other words, international infection rates may barely have started to climb (Figure 4).

Figure 4 Cases in China and Outside China (until March 4)

Source: WHO, China National Health Commission, Difference Group

The rest of Asia could see continued case growth until early second quarter. Despite dramatic increases of new cases initially, Japan and South Korea will use economic measures and stronger containment to halt the crisis. In Southeast Asia, the cases have so far been fewer, except for Singapore, Malaysia and Thailand.

ASEAN growth engines, such as the Philippines, Indonesia and Vietnam, have strong structural growth potential. Yet, containment in emerging Asia depends dramatically on the capabilities of these countries to subdue the few existing cases and contain imported cases in the future. The same goes for South Asia, particularly India, Pakistan and Bangladesh.

Due to extensive and interconnected flows of trade and investment, significant reliance on Chinese and Asian tourism, and deep multinational supply chains, case growth in Europe will continue early second quarter, which could drive several countries and localities under lockdown to halt or slow down the spread.

Recessionary pressures come in a very bad time, with German GDP stalling, while France and Italy are contracting, and the UK is preparing for its post-Brexit economic hangover. In the fourth quarter of 2019, the Eurozone grew only 0.1%; the weakest since the contraction in early 2013. Italy is a particularly intriguing case. Ass the only European country to have barred flights to and from China, Hong Kong, Macau and Taiwan, it has still seen a dramatic increase of cases, centered in the regional towns of Lombardi, near Milan; the country’s business hub.

In Europe, there is much worse ahead in the coming months, if these pressures are not offset with appropriate fiscal and monetary policies.

Until recently, the Middle East and the Americas had not witnessed sustained case growth. Now, local transmissions have begun. In Iran, the dramatic rise of the infections and even faster increase of deaths– particularly those of leading government members – reflect higher-than-recorded rate of contagion, the presence of undetected virus clusters, or external synthetic efforts to exploit the virus outbreak.

In North America, local transmissions are now on rapid rise, though from a low starting-point. Despite greater awareness of COVID-19 and ample additional time to prepare, politization replaced mobilization in the US, which resulted in a series of containment mistakes. If the White House can manage the crisis, collateral damage would be limited to the early second quarter. The IMF projects US growth to suffer a 0.4% slowdown in the annualized growth; that is, from 2.0% to 1.6%. But that would require rapid success in containment – and early signs are not promising.

In Africa, outbreaks have already begun in the northern Maghreb (Algeria) and sub-Saharan countries (Nigeria, Senegal). Starting from the low-point, the cases are still few. Yet, most countries became able to test for the virus only in late February. In modeling simulations, the highest importation risk involves countries – such as Egypt, Algeria, and South Africa – that have moderate to high capacity to respond to outbreaks. Countries at moderate risk – including Nigeria, Ethiopia, Sudan, Angola, Tanzania, Ghana, and Kenya – have variable capacity and high vulnerability.

If cases escape detection, weak healthcare systems, coupled with endemic poverty and social instability, could result in a secondary epidemic with potential global impact.

Distressing realities

If the extended impact scenario will take hold and economic damage outside China will broaden well into the second quarter or even beyond, the downgrades that will follow in March and April will be replaced with a series of new ones in early summer.

In major economies, few sectors, particularly consumer goods, will rebound relatively quickly, but others are already likely to see lower demand for a far longer duration than initially anticipated – particularly aviation, tourism, hospitality, transportation – and if the damage spreads, still other sectors will follow in the footprints.

In an adverse scenario, the consequent impact on global economy would prove more significant thereby dragging global growth prospects from the expected 2.5 to 3% at the beginning of 2020 to around 1.8 to 2.2%, possibly even more. In Europe, new virus clusters would sustain economic uncertainty and market volatility. In the polarized United States, the belated response would be compounded by the divisive fall election. Around the world, transmissions would climb with new virus clusters, while global pandemic would fuel an international recession that would prevail until 2021, in the absence of US-Sino Phase 2 deal or temporary trade truce.

Since efforts to limit the virus to China have failed, many countries will soon shift focus toward mitigation rather than containment, hoping to slow the spread to stop hospitals all being overwhelmed at once. In the mitigation phase, quarantines are likely to be replaced by “social distancing” measures, such as closing schools as most recently in Italy. Since two-thirds of the infected traveling internationally are undetected, economic recovery could compound multiple cycles ofundetected human-to-human local transmissions globally.

Whether it is called epidemic or pandemic, the outbreak could eventually fade away, especially if countries manage to limit super-spreader events. As of yet, that has proved wishful thinking. In light of the current infection volumes, exponential increases in some countries and new virus clusters in others, the COVID-19 pandemic could infect two of three people globally. In the near future, early signs to that effect outside China would feature “unexplainable” new virus clusters with severe pneumonia in older people.

In the past, some viruses have eventually fizzled out, while others have morphed into global pandemic, like the Spanish flu a century ago. And that’s why what happens in March will precipitate what’s ahead in the rest of 2020 or beyond – in good and bad.

Source of documents:The World Financial Review, March 6